How I Manage my Money As a Young Adult

We all know it's important to manage our money well, but holy mother of mackerel can it feel overwhelming to actually do so. At least on the surface. I think that personal finance1 can be complicated, but for most people, it's one of those fields where 20% of the knowledge takes you 80% of the way to where you want to be.

For context, I'm 25 and don't have a mortgage or kids.

The Power of non-linearity

If you have an intuitive understanding of feedback loops and exponential behaviour in systems, then the following will seem overwhelmingly obvious. But I think it's useful to go through a simple scenario anyway.

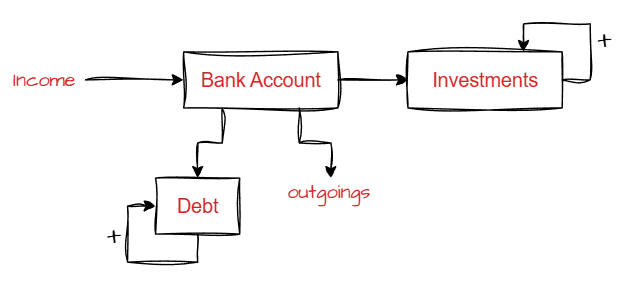

Here's a super simple model of my finances. I don't have a mortgage (nor do I have any loans, but I'm including debt because I think it's important to look at).

Let's say that you have a monthly income of £2000 and require £1500 on average to live; to cover the costs of everything that isn't categorised as discretionary spending. Lets also assume that any surplus (£500 in this case) is split evenly between discretionary spending and investing. Furthermore, the following assumptions apply:

Bank interest rate: 2.5%

Debt interest rate: 20%

Investment return rate: 6%

Income and spending remain fixed.

The takeaway here is to eliminate all negative feedback loops and maximise any positive feedback loops. The rate of growth of debt is higher than that of bank interest and investment return combined; the net result is a downward acceleration of wealth. I'm sure nearly everyone reading this isn't knowingly allowing 20% credit card interest to run off with all their hard-earned cash; I'm just trying to illustrate the need to focus on rates of growth, both positive and negative. I.e. pay off all debt as soon as possible before pursuing any investments.

For completeness, here's what that looks like over the same time horizon. Note the difference in the final wealth figure.

Earning Potential

Investing, for most people, is a form of wealth management, not wealth generation. Once you've got an investment plan in place, you very quickly run into the limiting factor of contribution. For most people my age, it's a lot more beneficial to invest in earning potential, rather than the directly into the market. This could mean pursuing further qualifications or it could mean spending the time and money to relocate to a new location or industry.

I'm personally thinking about pursuing an MBA when I get back from Australia. Just a thought for now.

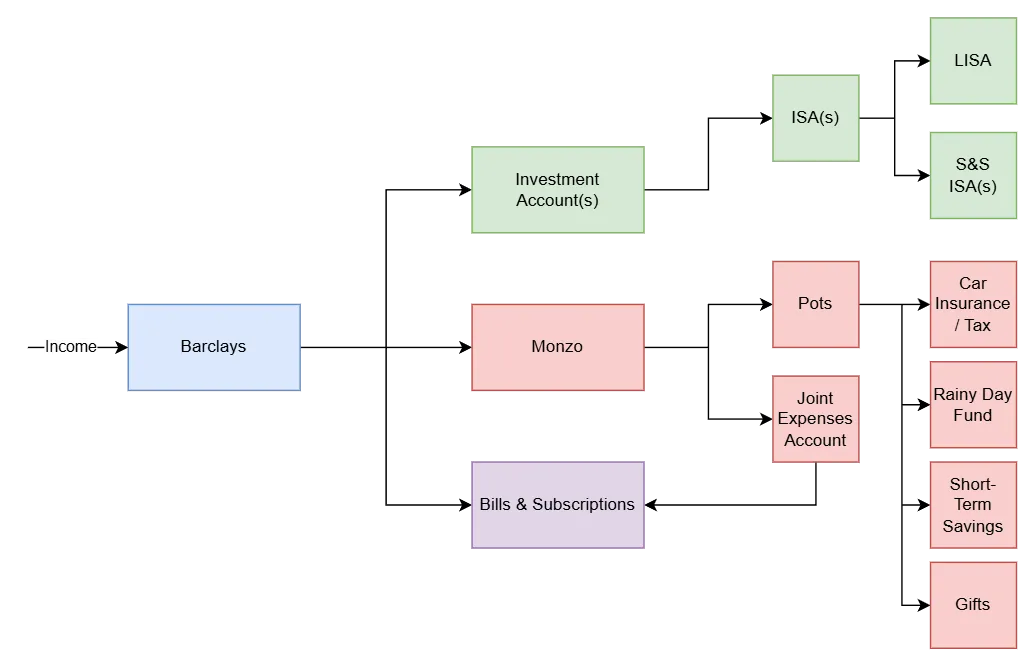

Where my Money Flows

Per month, this is the gist of it:

This is all automated by direct debits and account contribution settings, as per a budget I keep in Google Sheets.

For those not UK-centric, Barclays is one of the major national traditional banks, with Monzo being a digital online only bank. Monzo allows you to set up pots (mini accounts within your current account) which make it easy to accumulate funds for larger less regular payments (e.g. car insurance).

ISAs are tax-advantaged savings/investment accounts, akin to a 401k. A Lifetime ISA (LISA) is an ISA that allows the government to match 25% of your contribution, with a maximum government contribution of £1000/year. I'll try to max this out overy year if I can prior to buying a house. My LISA account is with Hargreaves Lansdown.

What I Personally Invest In

When it comes to investing, I think the following goals are important:

To make the process of investing simple - Compound growth rewards having your skin in the game for a long period of time and a good promotor of starting early and sticking with it is to have a simple plan that doesn't require a lot of thinking or reworking.

To have an idea of my personal risk tolerance and maximise expected returns to suit.

To avoid the plethora of cognitive and behavioural biases which plague the world of money management. See this page on Investopedia; the source of the below chart:

Just being aware of these biases probably won't prevent them from happening, but you've gotta do what you can. And if anything it's more reason to stay away from active investing.

As with most people, the above three points strongly suggest passive investing - the good ol' approach of dollar cost averaging 2 into a diversified set of index funds. Which is exactly what I do.

I have two stocks and shares ISAs - one with Vanguard and one with InvestEngine. I, like many others, jumped ship from Vanguard when they increased their fees, although I prefer InvestEngine anyway; their platform offers a much better user experience and they offer the same expansive list of funds. If by serendipity you've stumbled upon this page while in the market for a platform to invest ETFs on, then do give Invest Engine a try with my referral link, and we'll both get a randomly selected investment bonus between £20 and £100.

As for specific ETFs, I used to be primarily invested in VUSA - S&P500 UCITS - Dist. and a little VWRL - Vanguard FTSE All-World UCITS - Dist., but now I'm diversifying away from being primarily positioned in the Northern American market. It's hands-down been the market to put your money in in recent times, but that doesn't mean things will continue to be rosy; all the Japanese investors from not so recent past would be inclined to agree.

So for now, my allocations looks like this:

Neither of these are ideal in terms of portfolio management and there's lots of allocation overlap. But it's just what my investments happen to look like at the moment.

I should note that I don't hold any bonds/gilts. While I do have a sensible cash reserve, all my money is parked in ETFs. The volatility may be higher, but that's the price I'm willing to pay for higher expected returns. I'm lucky in that I have absolutely no problem sleeping at night with most of my net worth in equities. I also don't plan on changing this: I'll stay with 100% equities throughout my life instead of redistributing my portfolio to hold a slowly increasing proportion of bonds.

Additional Tidbits

Some general points of wisdom I've come across:

- Try to live within your means - lifestyle creep is very real.

- Aim to maximise any employer matching re my pension (although where I currently work I'm limited to the measly legal minimum of 3%).

- Don't let financial decisions rule your life. Life is messy and happiness isn't numerically quantifiable. Sometimes the right decision isn't the right financial decision.

Here, by "personal finance", I mean financial knowledge which is generally sensible and applicable for most people. Obviously personal finance is personal and highly specific on an individual basis.↩

As a Brit, I should be saying "pound cost averaging", but quite frankly that just sounds wrong for some reason.↩